How to Meet the Spouse Visa Income Requirements for Visa Extension Applications, Spouse Visa Switching Applications

As part of UK family visa applications including UK Spouse visa application and UK Fiance Visa applications, the applicants and their partner must prove their income to a certain threshold to make a successful application. The Spouse Visa for UK applications include partner visa as an unmarried partner, civil partners when they have a legally registered civil partnership and married partner visa applications.

The UK financial requirements apply to all applications for visa applications made outside the UK (entry clearance applications for UK) and visa extension as a spouse inside the UK (commonly known as Further Leave to Remain in UK (FLR)). Many people referred to this visa as a marriage visa which is not correct to say as in immigration rules, there is no such visa. Though there is a category called Fiance Visa which is used to enter the UK and get married to a British Citizen or person settled in the UK. Besides financial requirements, other requirements also apply such as documents to prove available accommodation i.e Mortgage statement, Tenancy Agreement, latest utility bills and immigration home survey report.

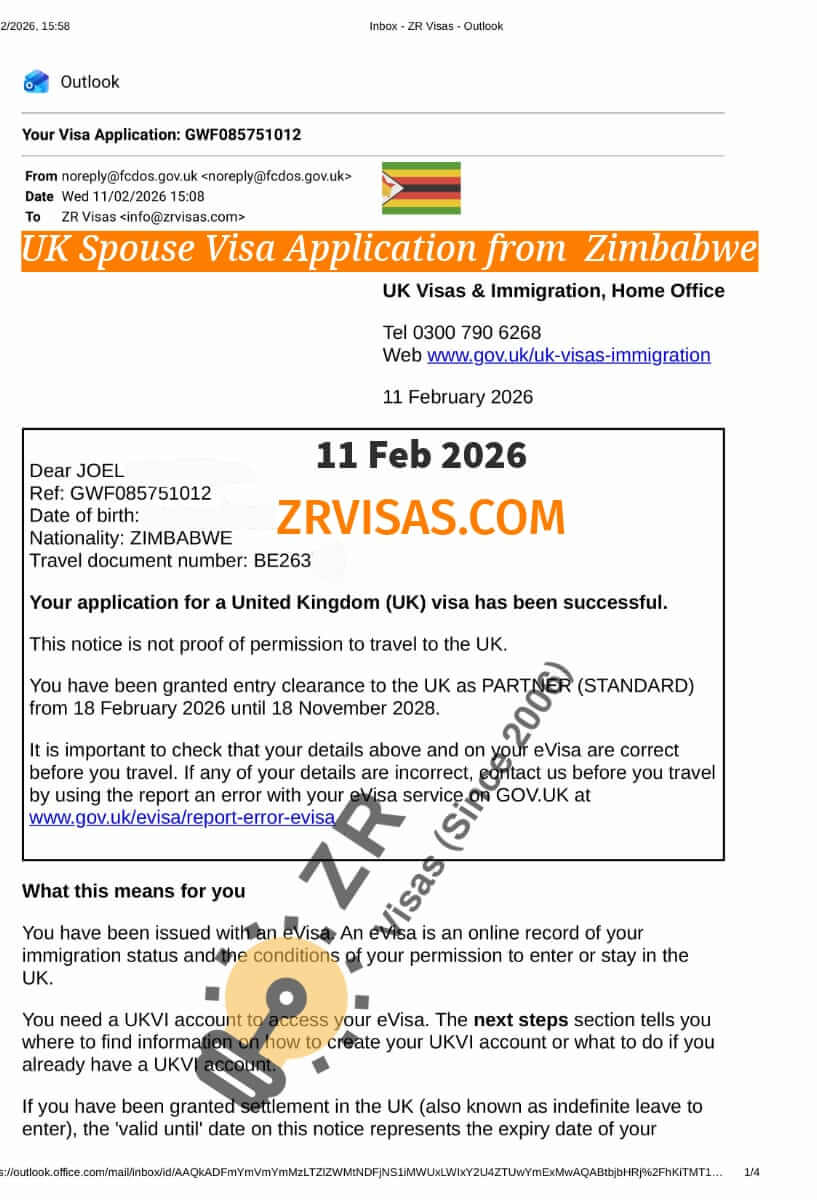

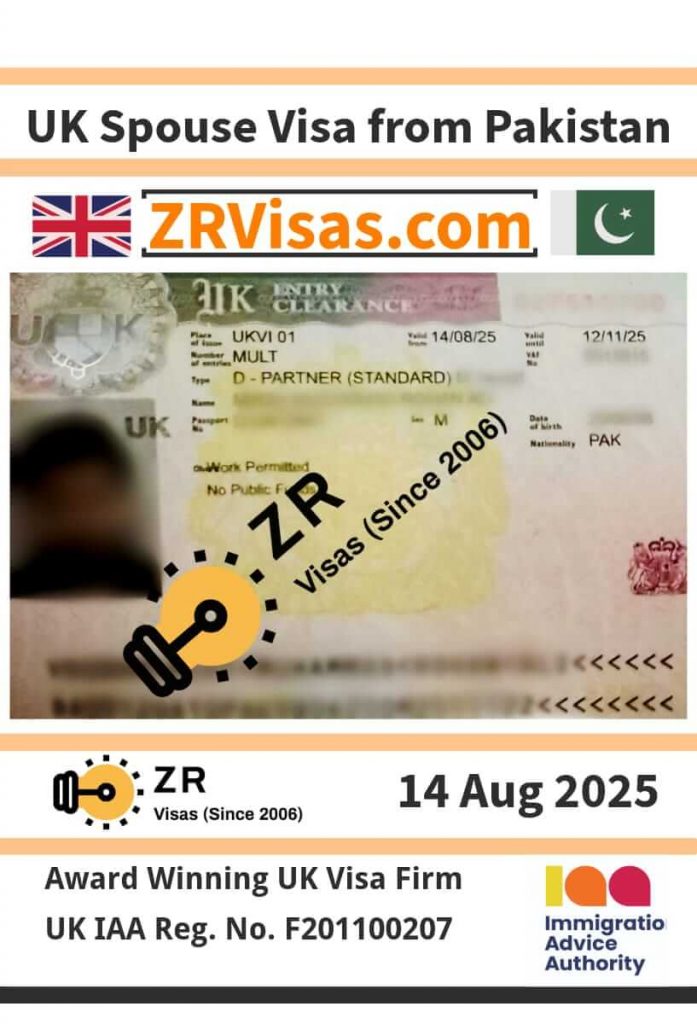

Our 100% Success Rate for UK Family Visa Applications including UK Fiance Visa Application and UK Spouse Visa Application

UK Visas, Immigration and Nationality Services

Minimum income requirement for UK Partner Visas including Fiance Visa to get married in UK and Spouse Visa for UK

For a partner to join their husband or wife in UK, the UK sponsor must have an annual income of at least £29000 per year. For employment income, gross amount is considered. The gross income is before deduction of income tax and national insurance.

Income requirement for dependent children of spouse -applying at same time or later- Pre 11 April 2024 applications

In addition to the £18600 income requirement, for the first child applying to join parents in the UK, the £3800 is required. For the second child, income requirements of £2400 will apply.

For example, if the wife is applying for a spouse visa with two children. They need to provide an annual income of:

Income Requirement for Wife: £18600

Income Requirement for first child: £3800

Income Requirement for second child: £2400

Total Income Requirement = £24800

Income Requirement for children who are British Citizen or have Permanent Residence in UK

For the purposes of income requirement, children who are British citizens or have ILR (Indefinite Leave to Remain in UK) or who are EEA citizens are ignored. No income is required for them.

Allowed sources to meet the income for financial requirement of UK Fiance Visa & Spouse visa

Income can be proved from employment (permanent or temporary such as agency work), self employment, director of company in UK, savings over £16000 for £18600/ year income requirement or £16500 for £29,000 a year income requirement, rental income from commercial or residential property, income from company dividends. Savings may be held in investment account. The income requirements can be met through savings alone if the UK sponsor or the applicant have savings £62500 or £88500 for income requirements £18600 and £29000 respectively.

Confidently choose the best UK immigration firm for your next UK Visa application. Don’t just take our word for it—explore our 1000+ of Success Stories for our clients in 71 countries & 900+ Customer Testimonials on Google, Yell, Facebook & Trustpilot

Borderless Assistance: Since 2006, Proudly Represented Families & Businesses from 71 Countries

See our latest success stories from across the world.

Afghanistan 🇦🇫, Albania 🇦🇱, Algeria 🇩🇿, Argentina 🇦🇷, Austria 🇦🇹, Australia 🇦🇺, Bahrain 🇧🇭 , Bangladesh 🇧🇩 Belgium 🇧🇪, Botswana 🇧🇼, Brazil 🇧🇷, Burkina Faso 🇧🇫, Canada 🇨🇦, Colombia 🇨🇴, Cuba 🇨🇺 , Cyprus 🇨🇾, Czech Republic 🇨🇿, Denmark 🇩🇰, Egypt 🇪🇬 , Gambia 🇬🇲, Ghana 🇬🇭, Greece 🇬🇷, Guinea 🇬🇳, Hong Kong 🇭🇰, Hungary 🇭🇺, India 🇮🇳, Iran 🇮🇷, Israel 🇮🇱, Italy 🇮🇹, Jamaica 🇯🇲, Japan 🇯🇵, Jordan 🇯🇴, Kenya 🇰🇪, Latvia 🇱🇻, Lebanon 🇱🇧, Malaysia 🇲🇾, Mauritius 🇲🇺, Mexico 🇲🇽, Morocco 🇲🇦, Myanmar 🇲🇲, Namibia 🇳🇦, Nepal 🇳🇵, Netherlands 🇳🇱, New Zealand 🇳🇿, Nigeria 🇳🇬, Palestine 🇵🇸, Pakistan 🇵🇰, Philippines 🇵🇭, Poland 🇵🇱, Portugal 🇵🇹, Romania 🇷🇴, Russia 🇷🇺, Saudi Arabia 🇸🇦, Senegal 🇸🇳, Singapore 🇸🇬, Spain 🇪🇸, Sri Lanka 🇱🇰, Sweden 🇸🇪, Syria 🇸🇾, Thailand 🇹🇭, Timor Leste 🇹🇱, Tunisia 🇹🇳, Turkey 🇹🇷, United Arab Emirates UAE 🇦🇪. UK 🇬🇧, Ukraine 🇺🇦, Uzbekistan 🇺🇿, USA 🇺🇸, Vietnam 🇻🇳, Zambia 🇿🇲, Zimbabwe 🇿🇼

Discover how we provide comprehensive legal representation for UK spouse visa applications, reuniting loved ones from 71 countries

Confidently choose the best UK immigration firm for your next UK Visa application. Don’t just take our word for it—explore our 1000+ of Success Stories for our clients in 71 countries & 900+ Customer Testimonials on Google, Yell, Facebook & Trustpilot

Borderless Assistance: Since 2006, Proudly Represented Families & Businesses from 71 Countries

See our latest success stories from across the world.

Afghanistan 🇦🇫, Albania 🇦🇱, Algeria 🇩🇿, Argentina 🇦🇷, Austria 🇦🇹, Australia 🇦🇺, Bahrain 🇧🇭 , Bangladesh 🇧🇩 Belgium 🇧🇪, Botswana 🇧🇼, Brazil 🇧🇷, Burkina Faso 🇧🇫, Canada 🇨🇦, Colombia 🇨🇴, Cuba 🇨🇺 , Cyprus 🇨🇾, Czech Republic 🇨🇿, Denmark 🇩🇰, Egypt 🇪🇬 , Gambia 🇬🇲, Ghana 🇬🇭, Greece 🇬🇷, Guinea 🇬🇳, Hong Kong 🇭🇰, Hungary 🇭🇺, India 🇮🇳, Iran 🇮🇷, Israel 🇮🇱, Italy 🇮🇹, Jamaica 🇯🇲, Japan 🇯🇵, Jordan 🇯🇴, Kenya 🇰🇪, Latvia 🇱🇻, Lebanon 🇱🇧, Malaysia 🇲🇾, Mauritius 🇲🇺, Mexico 🇲🇽, Morocco 🇲🇦, Myanmar 🇲🇲, Namibia 🇳🇦, Nepal 🇳🇵, Netherlands 🇳🇱, New Zealand 🇳🇿, Nigeria 🇳🇬, Palestine 🇵🇸, Pakistan 🇵🇰, Philippines 🇵🇭, Poland 🇵🇱, Portugal 🇵🇹, Romania 🇷🇴, Russia 🇷🇺, Saudi Arabia 🇸🇦, Senegal 🇸🇳, Singapore 🇸🇬, Spain 🇪🇸, Sri Lanka 🇱🇰, Sweden 🇸🇪, Syria 🇸🇾, Thailand 🇹🇭, Timor Leste 🇹🇱, Tunisia 🇹🇳, Turkey 🇹🇷, United Arab Emirates UAE 🇦🇪. UK 🇬🇧, Ukraine 🇺🇦, Uzbekistan 🇺🇿, USA 🇺🇸, Vietnam 🇻🇳, Zambia 🇿🇲, Zimbabwe 🇿🇼

Documents required for UK spouse visa income requirements, Income from employment or business to meet financial requirement for UK fiance and spouse visa applications

The required list of documents to prove income to meet financial requirements will vary, depending on the source of income and whether you are combining two or more sources to meet the requirement. For employment income, job must be held for at least six months with same employer. The employment to meet the income requirement for UK partenr visa can be salaried employment or non-salaried employment. Remeber, rules to calculate the anncal income to meet the financial (minimum income) are different for salaried employment and hourly rate paid employment. Also, for variable income, the yearly income may be calcualted in more than one ways.

Remember, the exact list of required documents may vary depending on individual circumstances and the combination of income sources. It’s always best to consult the latest guidelines or seek professional advice to ensure compliance with the current immigration rules.

The general list of documents for income from employment is given below:

Salary Slips for the last 6-12 months depending on many factors such as length of employment, monthly income, income in the last 6 months or last 12 months.

Bank statements for the same period as above showing income received in bank account

A letter from employer issued within 30 days of making of visa or FLR application.

P60 of recent financial year

A signed Employment contract

Other related documents to prove income and employment, depending on the circumstances, may vary from case to case basis.

Spouse visa and Fiance Visa financial requirement- Income from self-employment such as sole traders, partnership firms

The required list of documents to prove income to meet financial requirements for a UK partner visa will vary, depending on whether income is from one financial year or a combination of the last two years. The list of documents, for income from self-employment, to meet the financial requirements for spouse visa, is given below:

- Proof of Registration with HMRC

- SA302 or SA300 often referred as Tax Calculations from HMRC

- Invoices for the recent full financial and tax year

- Recent Tax Return for the last full financial and tax year (6 April to 5 April)

- Partnership tax return for most recent ended tax year

- Bank statements for the same financial year as per the tax return

- Letter from an accountant who is member of a professional bodies in UK confirming the authenticity, and audit of the accounts and confirming the income

- Evidence of tax paid and payable to HMRC

- Proof of continuity of the business such as a recent business bank statement or an invoice

Update: NEW Minimum Income Requirement for UK Spouse Visa, Fiance Visa and Dependent Children, rising from £18600 to £29000 a year from 11 April 2024

Updated 1 Feb 2024

This has now been confirmed by UK Government on 30 Jan 2024 that-

“The spouse/partner visa minimum income will first increase to £29,000 on 11 April 2024; to around £34,500 at an unspecified time later in 2024; and finally to around £38,700 by early 2025.”

The UK Secretary of State for the Home Department announced on Dec 4, 2023

“Fourthly, we will ensure that people bring only dependants whom they can support financially, by raising the minimum income for family visas to the same threshold as the minimum salary threshold for skilled workers, which is £38,700. The minimum income requirement is currently £18,600 and has not been increased since 2012. This package of measures will take effect from next spring.”

When will the new higher income requirement for UK spouse Visa and Fiance Visa be enforced?

The spouse/partner visa minimum income will first increase to £29,000 on 11 April 2024; to around £34,500 at an unspecified time later in 2024; and finally to around £38,700 by early 2025.

What are changes in the income threshold for UK family visas, how much income requirement has been increased?

The proposed change in the financial requirements for the family visas from £18600 per year to £29000 a year, an increase of £10,400, a change of 56 percent. The change will affect low income UK sponsors who want to bring their partner and children to the UK. The UK family visas include UK fiance visa, UK partner visa such as spouse visa and dependent children visa applications for UK under appendix FM. The current annual income threshold for sponsoring an additional family member is £3800 for a first child and £2400 for each additional child. These amounts could go high as much as £8000 and £5000 respectively. This is a forecoasted change by our inhouse immigration experts.

I am already in the UK on a family visa. Would new income requirements £29000 per year apply to me at the time of visa extension?

The UK Home Office confirmed that- “Those who already have a family visa within the five-year partner route, or who apply before the minimum income threshold is raised, will continue to have their applications assessed against the current income requirement and will not be required to meet the increased threshold”.

This means that the change will not affect the family members under appendix FM 5 years route, who are already in the UK, at the time of their application for spouse visa extension.

Applying for UK family visa before change in the income requirements

In view of the above, it may be worthwhile considering making a UK partner visa application earlier than you originally planned before change takes effect on 11 April 2024. Contact our team of professional UK family visa specialists for the legal representation of your family visa applications.

UK Visa Applications affected by new UK family visa income requirements of £29000

The following types of visa applications are likely to be affected by change in the immigration rules for higher income requirements £38700 for family visa-

- UK Spousal Visa Applications

- UK Fiance Visa Applications

- UK Dependent Children Visa Applications

- UK Visa Application as parent/ carer of a British Child

Exemption from meeting the financial requirements but meeting the requirements through ‘adequate maintenance and maintenance requirements’

Where the applicant’s partner is in receipt of any of the following benefits or allowances in the UK, the applicant will be able to meet the financial requirement at the UK partner application stage by providing evidence of ‘adequate maintenance’ for UK visa, rather meeting an income threshold. You need to show you and your family have enough money to adequately support and accommodate yourselves without relying on public benefits.

- Carer’s Allowance

- Disability Living Allowance (DLA)

- Severe Disablement Allowance

- Industrial Injuries Disablement Benefit

- Attendance Allowance

- Personal Independence Payment

- Armed Forces Independence Payment or Guaranteed Income Payment under the Armed Forces Compensation Scheme

- Constant Attendance Allowance, Mobility Supplement or War Disablement Pension under the War Pensions Scheme

- Police Injury Pension

The adequate maintenance should be calculated before submitting the visa application. The process normally includes the full appreciation of income (including income from public benefits), savings, housing cost, council tax cost and other expenses such as child maintenance payments.

What if I cannot meet the minimum income requirement for a UK Spouse Visa Extension Application?

You need to show you and your partner meet the minimum income requirement if you want to settle in 5 years as a partner. If you are already in the UK and you do not meet the requirement, you may be able to settle in 10 years, often referred to as the 10 years partner route or 10 years parent route or 10 years private and family life route.

How can I stay up to date on this development on the income requirements for uk spouse visa, fiance visa and dependent children visa?

We will update this section of our website on hearing further guidance from the UK Home Office (UKVI). You can bookmark this page to stay up to date on this change.

Video transcription on UK Spouse Visa Financial Requirements

Hello I am Naveed Mukhtar from ZR Visas. We are an Immigration Advice firm Since 2006, have clients in more than 60 countries. We are family Visa specialist, have 100% success rate in many UK Visa applications including UK fiance visa applications, UK spouse visa extension and switching applications, British Nationality Applications, Indefinite Leave to Remain, UK Sponsor License Applications, Skilled Worker Visa and Dependents Applications and a lot more. You can see our work on our success stories page on ZRVisas.com. We have hundreds of five star reviews on Google, Trustpilot, Facebook and Yell, just search ‘ZR Visas’ to find how we are helping clients around the world.

In this video, we will talk about the new Financial Requirements introduced by the Home Office recently. A lot of people have been asking questions and trying to understand how the changes will impact them and what will happen if they made their application before the changes and what is the current threshold and what will be the income requirements by end of the year and during the next year 2025. Starting from the current requirements for UK fiance visa application and UK spouse visa application, the current income threshold has been increased from £18,600 to 29,000 a year. Partner visa applications for those who are joining their partner from abroad over on or after 11th of April 2024 or they are making a switching application from a different Visa route to partner visa application, they will need to meet the new income criteria for income requirement that is £29,000 a year.

If you or your partner are in receipt of certain disability benefits such as Personal Independence Payment (PIP) or Carer Allowances or other disability benefits then you may be exempt from meeting the financial requirements. Different immigration rules will apply and you will have to meet sufficient accommodation and maintenance requirements to make a successful UK fiance and spouse visa applications.

Now, let’s talk about how you can meet the financial requirements if you are employed. You will need your last 6 to 12 months pay slips and bank statement to prove your income. The gross amount will be taken into account to calculate your annual income. When we say a grass amount it means the highest amount shown on your payslip before deduction of National Insurance and tax. Depending on your circumstances you may need to provide 6 to 12 months’ payslips with corresponding bank statements and a letter from an employer to confirm that you have earned that amount.

When we talk about self-employment, there are two different ways of being self-employed: one is you are a Sole Trader. And in that case, most likely, your financial year will start from 6th of April and will end on 5th of April next year. In that case, you will need to provide your most recent tax return for the year which has recently ended. It does not matter whether you have filed the tax return for that tax year or not but the home office will expect if the financial year has ended recently, the Home Office expect that you do file your tax return and provide the corresponding accounts letter from the accountant and related bank statements for the whole duration as your financial year.

The second mode of being self-employed is when people are directors of a company and in some cases, they are the sole director of the company and they are taking their salary or dividends from the company in return for the work they’re doing. The visa rules are complex; they are not as simple as compared to employment and self-employment.

These are not the only sources which you can use if you have some other income such as a rental income or you are in receipt of pension income. You can also combine these sources in some circumstances but remember not all the sources of income can be combined. Therefore it is better to get professional visa advice when you are thinking of joining two or more sources of income to meet Financial requirements.

I will say, the strict criteria applies to documents and evidence. The home office will need it as a part of the application, therefore it’s important that you provide the documents in prescribed format and the exact documents that you need.

Another other way of meeting the financial requirement for a partner visa is if you have a substantial amount of savings. We have details on the financial requirements on our spouse visa and fiance visa page at zrvisas.com, you can see that. We will keep our website updated for the latest updates on income requirements.

Now we talk about the people who submitted their UK visa application before 11th of April 2024. If you submit your application before 11th of April 2024, in that case, the immigration rules in place at the time of your original application will apply. This will be the same for UK spouse visa extension and for indefinite leave to remain (ILR) applications. If you are not sure, please consult a regulated immigration advice firm, like us, who can help you to understand which income threshold will apply to you.

We do provide a ‘Full Application Service’ for a Fixed Fee for UK Fiance Visa, Spouse Visa and all other UK Visa applications. And we have some of the Best Success Rate (100% for UK Fiance, Spouse Visa Extension & Switching) and you can see our work on our website at ZR vas.com at the success stories page. Our professional visa team of Immigration Firm can help you to do your visa application and can also provide additional support and can do urgent UK visa applications without any additional cost to you. We hope you have a better understanding of UK Immigration Rules now.

The income requirement is going to change by the end of the year, that’s what the home office has announced. Home Office announced that income threshold will increase to £34,500 by end of 2024 and by the start of next year 2025, the income threshold is likely to go at £ 38,700. We don’t know exactly when these changes will be implemented as the Home Office has not announced the dates yet but we will update our website as soon as we have the latest updates. You can visit our UK fiance visa and spouse visa pages to stay updated.

You can also follow us on Social Media platforms such as Facebook, Twitter, Instagram and we post over work and latest updates regularly. We do provide services to all clients around the world using phone, email, WhatsApp, post, Microsoft teams, Google Drive and a lot of other modern means we use to facilitate our clients around the world. Thank you very much for watching the video and should you need any assistance, please feel free to contact us.

Our contact details can be found on our website. We wish you all the best and we hope that for the new changes, you can meet the new income criteria for your next Fiance and Spouse Visa applications. If you need help and support, please contact the team.

Unable to Meet Financial Requirements due to Covid-19

Many people have been furlough by their employers, a lot of self-employed lot their income in the pandemic. This has caused many people unable to meet the financial requirements to apply for visa or extend stay. UK government paid 80 percent of the salary is paid to the employees. For the purpose of meeting spouse visa financial requirement, Home Office will counted as if employee received 100% of their salary or pay. Income received via the Coronavirus Job Retention Scheme or the Coronavirus Self Employment Income Support Scheme can count as employment or self-employment income for the period 1 March 2020 to 31 October 2021. In the tax return, this should not be mentioned as a business profits. HMRC has updated the tax return and introduced a section in the tax return where applicants can enter the income from the income support scheme. Once tax return is complete, tax calculations will show the added up figure for business profits and support amount.

We recommend to get professional immigration advice to find out the options you may have to extend the stay. Not only we provide personal visa advice after taking into consideration of your circumstances. Our team of expert immigration advisers is in hand to work out the alternative assessment options you may have and on how to extend your stay in UK.

Read our FAQs about Spouse Visa and Extension Applications

You might also like: